A listed solution for basis trading

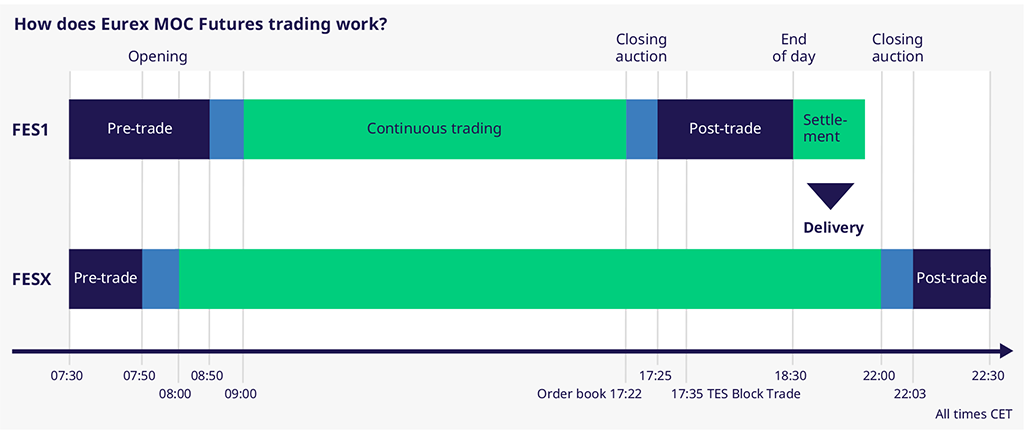

Eurex Market-on-Close Futures (Eurex MOC Futures) are designed to deliver multiple benefits to a market that, so far, has been dominated by OTC trading. Traditionally, basis, or market-on-close (MOC), trading requires high operational efforts with limited risk management opportunities as the basis is usually agreed on in the inter-dealer-broker market. While the basis is determined before the market close, the respective index futures trades must be entered into the Eurex® system after closing. This, amongst other harbors slippage costs.

In most cases, a MOC transaction has to be split into several trades as the final price (agreed basis plus index close level) is more granular than the index futures' tick size. That means that in order to enter them into TES Block Trade, MOC off-book transactions must be large enough in size to allow them to be split to achieve the desired final price.

By providing an on-exchange solution, Eurex supports MOC trading by futurizing basis trading in line with the regulatory agenda.